Case Study: Commencement Bank Reduces Paper and Increases Efficiency with AccuAccount

Commencement Bank is a $531 million financial institution based in Tacoma, Washington. Founded in 2006, Commencement Bank is focused on providing premier services for businesses and individuals, with an emphasis on traditional banking solutions. Commencement Bank has four locations in the Puget Sound area.

Previously, Commencement Bank maintained its customer and loan documents in hardcopy format. In this case study, you’ll learn how the bank reduced paper and increased efficiency with the help of Aloget.

“AccuAccount has made us more efficient.”

Shelly Campos, VP, Consumer Credit Administrator at Commencement Bank

Pain Caused by Paper Documents

Keeping customer and account documentation in paper file folders created numerous operational challenges for Commencement Bank. “Life before AccuAccount was painful,” said Shelly Campos, VP, Consumer Credit Administrator at Commencement Bank. “Files were big, bulky, messy, and not very efficient.”

Sharing customer information between branches involved physically moving files from one location to another. Administrative staff spent countless hours printing, hole punching, and filing paper documents.

Preparing for audits and exams was challenging and time-consuming, too. Staff manually pulled files from the records room and carted them to the boardroom—instead of working on more important priorities.

Making the Switch to AccuAccount

At the recommendation of a colleague, Campos participated in a series of demos for AccuAccount, a document management system that’s built specifically for the needs of financial institutions. “Everyone from Alogent was so nice, and the demos were very interactive,” Campos said. After seeing the product in action, AccuAccount seemed like the natural fit for Commencement Bank. “AccuAccount looked very user-friendly, and it was also cost-effective,” Campos said.

Alogent's implementation process streamlined onboarding and enabled the team to get up and running quickly. Prebuilt mapping spreadsheets expedited the process and served as a point of alignment for Commencement Bank’s deposit and loan teams. “Mapping was easy because Alogent had already built the spreadsheets for us,” Campos said.

Efficiency through Digitization

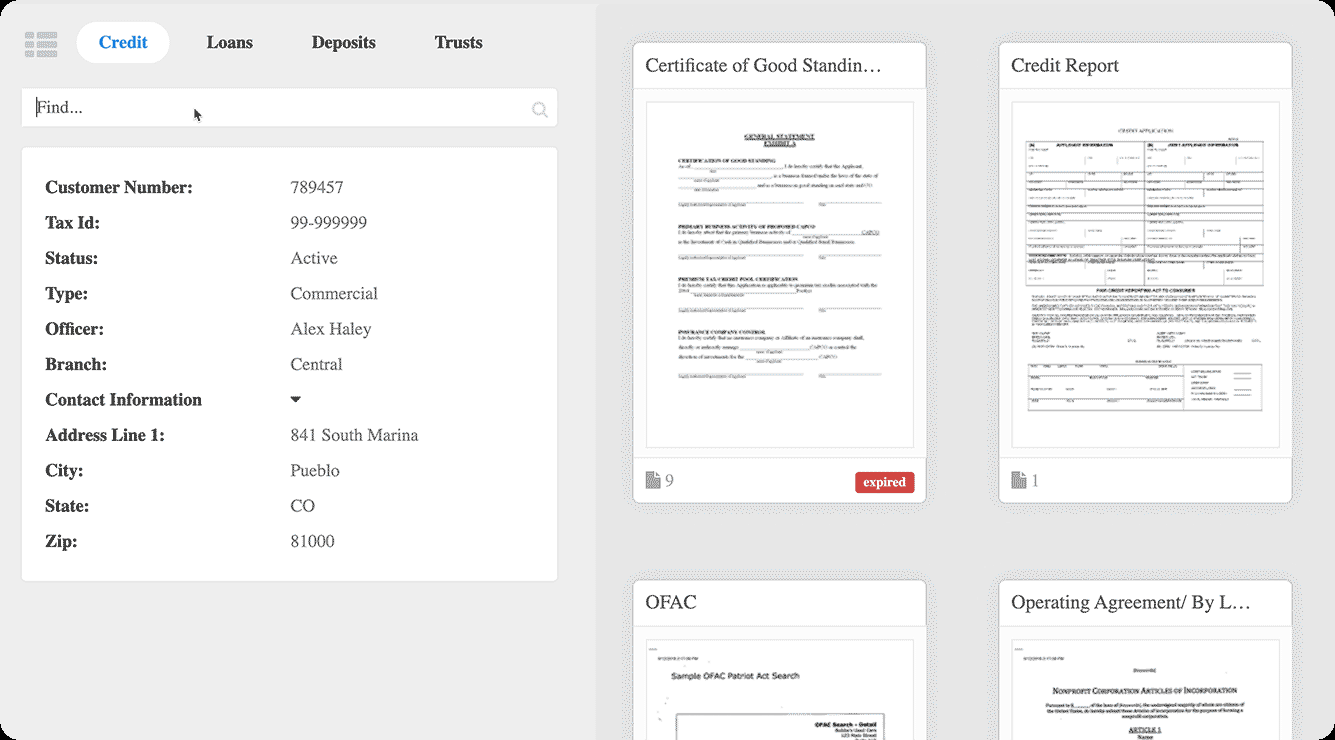

Centralizing Commencement Bank’s customer and account documentation in AccuAccount reduces the bank’s reliance on paper documents and empowers users to get more done. Staff no longer need to transport file folders from one branch to another. Now, users simply click on the AccuAccount icon on their desktop computers to find what they’re looking for. “AccuAccount has made us more efficient,” Campos said. “If we were still on paper, I don’t think we could have grown the way that we have.”

Lenders, in particular, benefit from increased accessibility to customer and loan information. “They’ve really enjoyed AccuAccount because the information is right there at their fingertips,” Campos said. “Any document that a lender needs is still accessible even if they’re out of the office or working from home.”

Preparing for audits is also easier with AccuAccount. Staff no longer have to cart massive piles of paper documents to the boardroom for review. Instead, auditors and examiners are given electronic access to the requested files—with just a few clicks of the mouse.

Reducing Administrative Effort

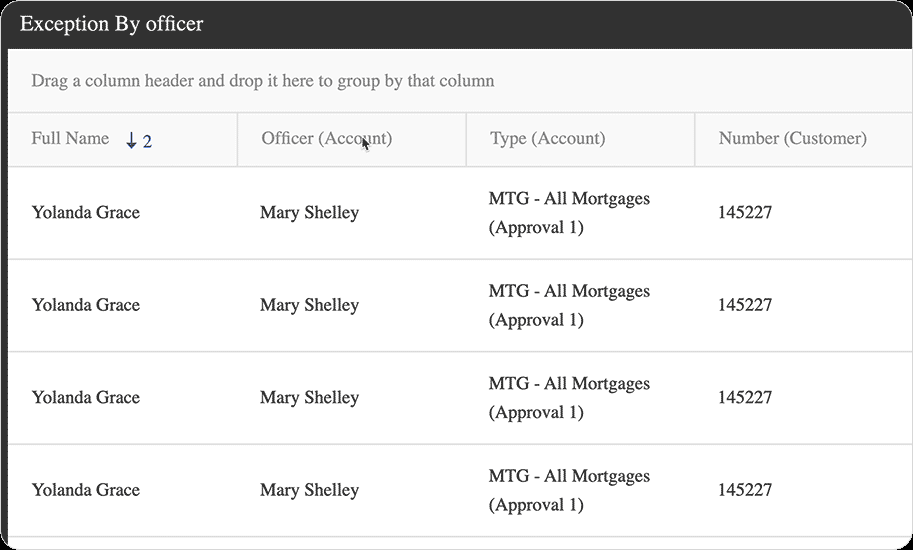

Built-in exception capabilities in AccuAccount help Commencement Bank achieve a more scalable reporting workflow. Automated exception reports arrive in users’ inboxes every Monday morning without any manual effort by Campos or her team. Dynamic Reporting in AccuAccount provides a flexible way to obtain rapid answers to complex questions.

Getting documents into electronic format is also straightforward with AccuAccount. “Drag and drop has been a lifesaver,” Campos said. “I can drag a document out of my email without having to save it on my desktop.” Alogent's flexible imaging capabilities was especially important for dealing with the influx of electronic signatures during the COVID-19 pandemic.

Collaborating for Success

Campos and her colleagues are particularly appreciative of Alogent's friendly, knowledgeable staff. “Alogent's staff is amazing,” Campos said. “I love the interaction and that they’re always willing to find an answer.”

Interested in learning more about AccuAccount for your bank? Contact us to schedule a free demo or request pricing.